# Meaningful work and meaningful relationships

Recently, I've finshed a few audiobooks and I'd just like to document my thoughts here.

Firstly, it is with Ray Dalio's quote of

Meaningful work and meaningful relationships

His guidance on living life through this principle made me realize that life really boils down to this fundamental principle. Money can't buy relationships, and money can't buy you work that is fun! Moreso, money can't buy you meaningful connections that will last you a lifetime.

As my mom always says (which I echo a lot myself):

能用錢解決的事是最簡單的

In english, this quote translates to The problems solvable with money are the easiest. When I was young, I didn't really appreciate the strength of this quote. I thought as long as I had money, I could do anything! Yet, as I grow older, I've come to realize that money is just a tool. A tool to gives you options to do things but doesn't solve the problems for you. The biggest example I've come to see is meaningful relationships.

# Rich Dad Poor Dad

Robert Kiyosaki has also given me a new way to think about money. To realize that a job is just to earn money. But to make money work for us is even more important.

Taking his quote and relating it to myself. I've been investing since I was in first year of university - starting from my very first paycheck. In fact, the whole reason I took on two part time jobs over the summer of my first year was to invest! At that time, I realized that making money work for you is crucial! It's important to build up a nest egg of wealth so that your moeny can be put to work for yoU!

I've also been thinking about this a lot lately. How can this possibly be sustainable if everyone keeps receiving money from dividends, then how would the economy function!?

Well, that is how technology works! Technology not only allows for improvements in our daily lives, but also reduces the number of workers that are needed to perform a job. This is precisely why, while many jobs are being automated, it is even more important than ever to be a part of the change. This can either be in the form of updating skill-sets to fit the new changing markets, or by investing in the future through stocks.

# More books I'm reading

I'm also in the process of listening to Steve Jobs and Obama's books. Autobiographies allow me to have a glimpse into how they think. Knowing their thoughts might unlock some realization for me too.

# A small footnote about the market conditions

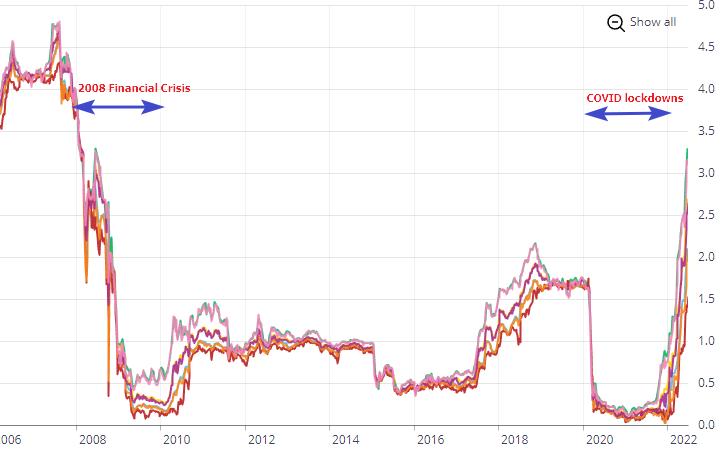

Interest rates on the T-bill from 2008 - 2022

Interest rates on the T-bill from 2008 - 2022

Right now, the federal reserve is rapidly performing quantitative tightening in addition to raising interest rates. This has been a much needed pullback. And while they quote supply chain issues with high demand but low supply, the reality is that credit is too easy to come by. With interest rates at its lowest point in the last 2 years, there's simply no more room for them to print more money to stimulate the markets. So their pullback currently is having a devastating effect on the markets - one of which is massive layoffs by big and small companies alike.

As Warren Buffet has said:

Only when the tide goes out do you discover who's been swimming naked.

Basically, many companies who borrowed too much money on credit now can't pay their money back and will go bankrupt very quickly. This includes people such as home-owners with mortgages and even share-holders of these over-leveraged companies.

Anyhow, I think I've rambled too much. This has been my half-year mark for 2022. And definitely one of the most interesting years in my life.

That's all!